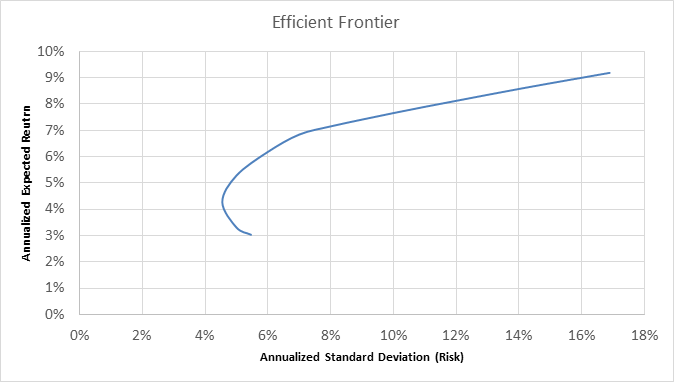

portfolio management - Max allowable return in Markowitz model - Quantitative Finance Stack Exchange

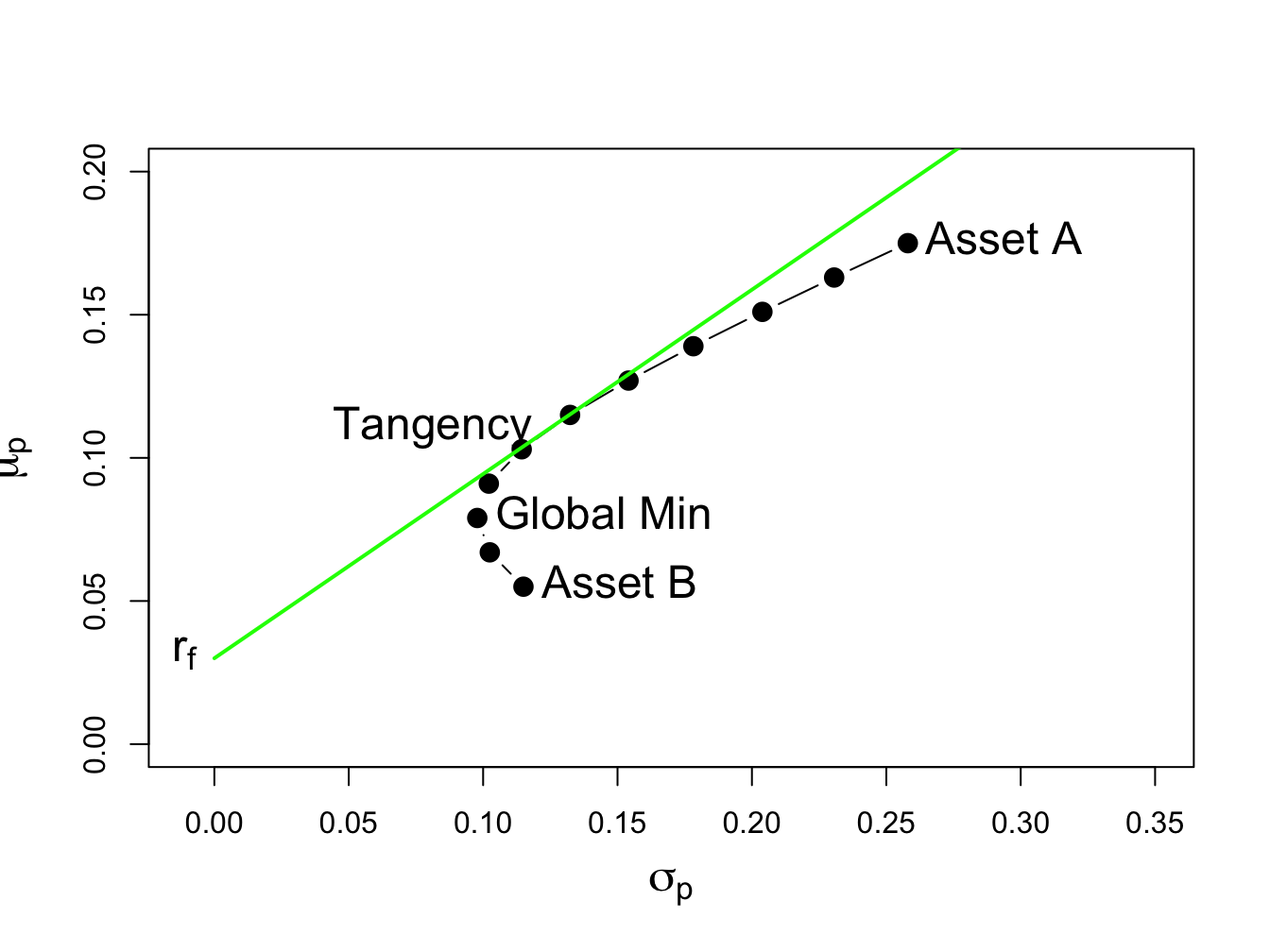

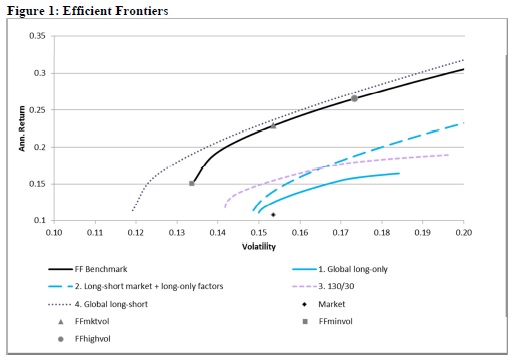

The efficient frontier for the ten assets with and without short sales... | Download Scientific Diagram

Efficient Frontier - Portfolio optimisation (optimization) with and without short-selling - File Exchange - MATLAB Central

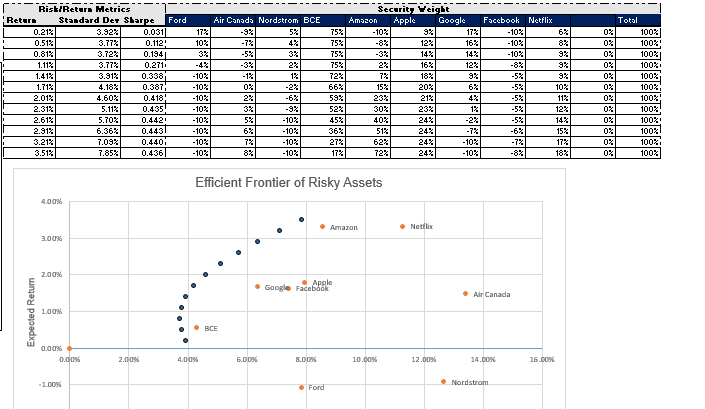

Economics 487 Homework #4 Solution Key Portfolio Calculations and the Markowitz Algorithm A. Excel Exercises: (10 points) 1. Dow

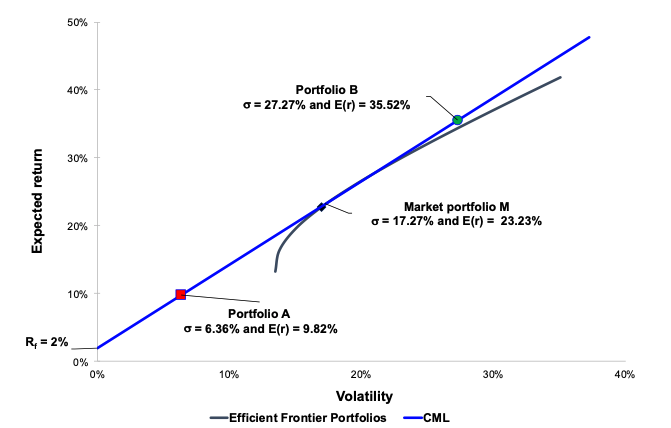

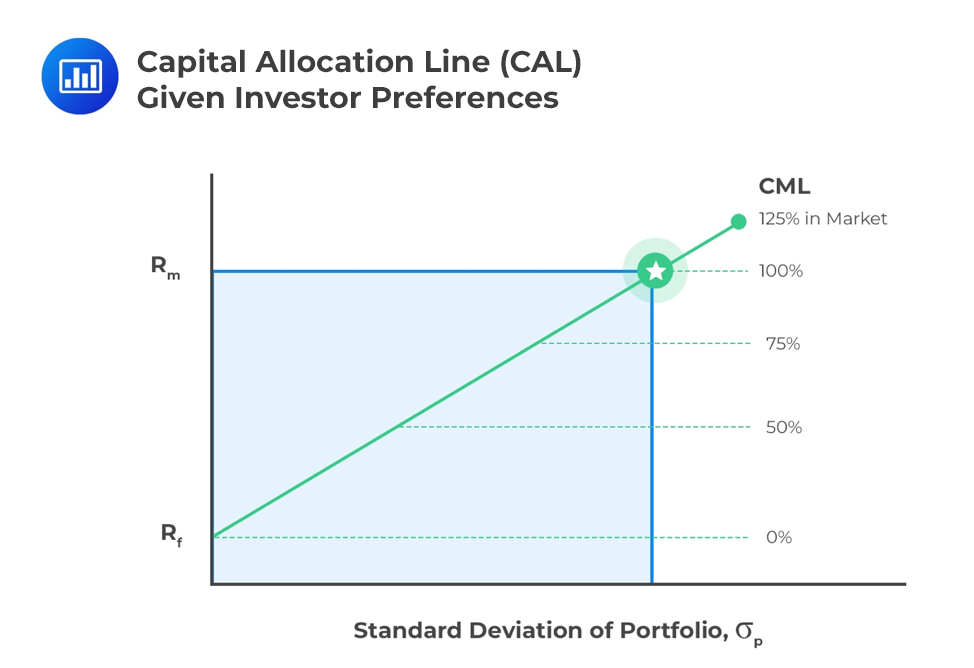

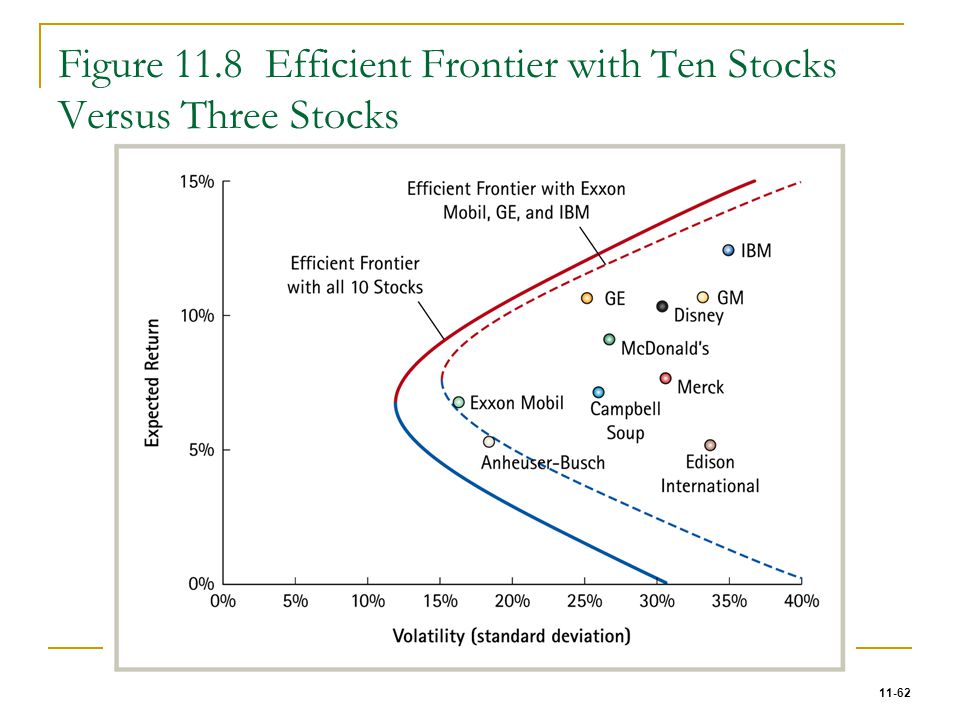

Chapter 8 Risk-Aversion, Capital Asset Allocation, and Markowitz Portfolio- Selection Model 1 By Cheng Few Lee Joseph Finnerty John Lee Alice C Lee Donald. - ppt download